Which U.S. States Protect Consumers Most from Debt Collection?

Understanding Your Rights by State

Debt can be overwhelming, but where you live in the United States can significantly affect how well you’re protected from aggressive debt collection. State laws add crucial layers of protection on top of federal rules, and these legal differences can affect everything from what property you keep to how much of your paycheck can be seized. Here’s a straightforward guide to understanding which states offer the strongest consumer protections and what those protections look like.

Why State Laws Matter for Debt Protection

While the federal Fair Debt Collection Practices Act (FDCPA) sets a baseline for fair treatment, each state can add its own rules to shield residents from harsh collection tactics further. Some states go far beyond the federal minimum, while others offer only basic protections. Knowing your state’s stance is essential for anyone facing debt challenges.

The 5 Key Areas of Consumer Protection

States are evaluated on five main legal protections for consumers with debt:

- Wage Garnishment Protections

Limits on how much of your paycheck creditors can take. Some states cap garnishment at lower levels than the federal standard, ensuring you keep more income for essentials. - Exemptions for Essential Property

Laws that protect your home (homestead exemption), car, household goods, and other basics from seizure. The value and scope of these exemptions vary widely. - Bank Account Protections

Rules that shield a minimum amount in your bank account from being frozen or seized, so you can still pay for food, rent, and emergencies. - Licensing and Regulation of Debt Collectors

There are requirements for debt collectors to be licensed and follow strict conduct codes. Unlicensed collectors cannot sue or collect in some states, offering a strong defense against scams and abuse. - Procedural Protections in Debt Lawsuits

Court rules require creditors to prove their case, properly notify you, and give you a fair chance to respond or dispute the debt.

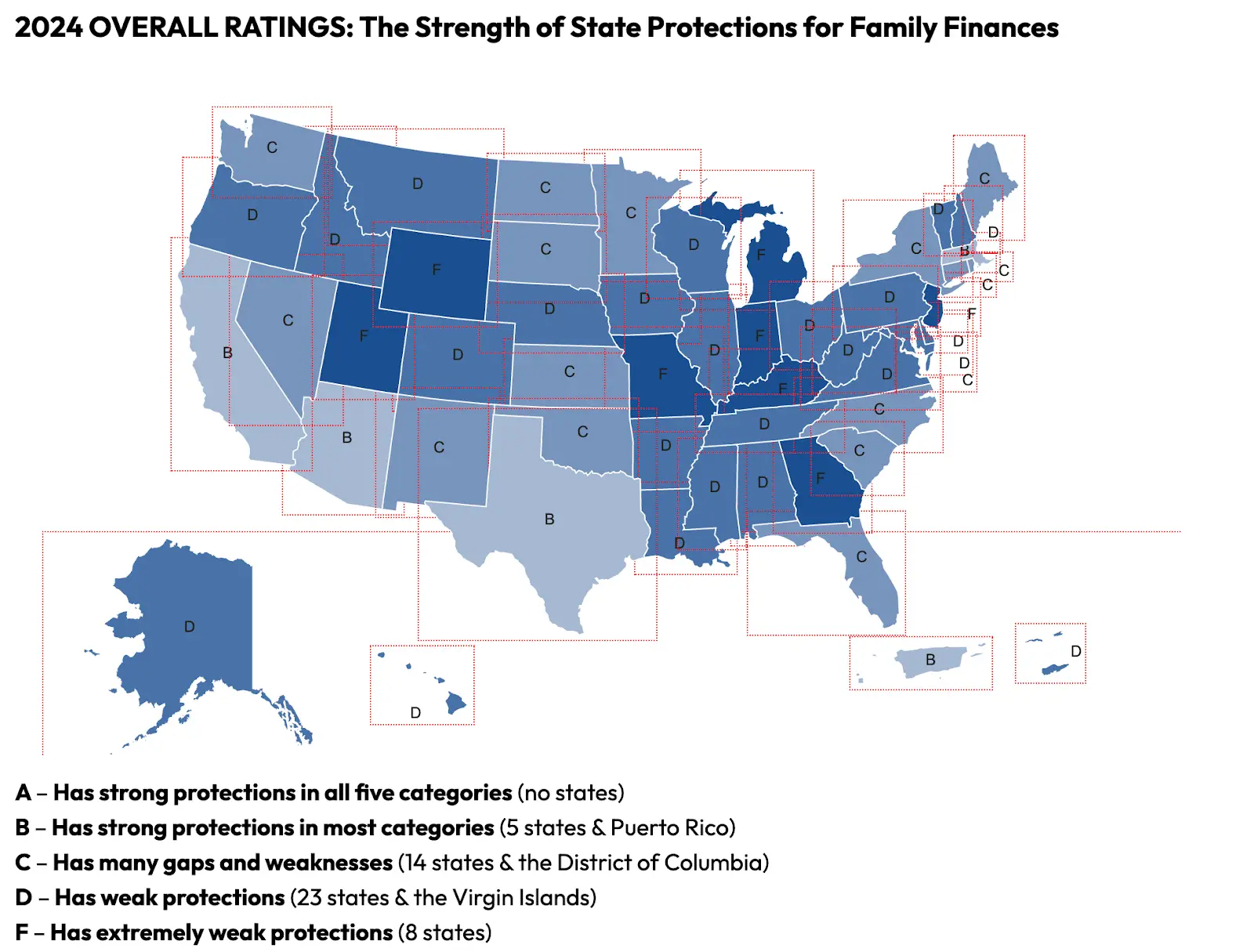

Which States Offer the Strongest Protections?

Recent analyses and legal reviews (such as those by the National Consumer Law Center) show that no state is perfect, but some are more consumer-friendly than others.

Top States for Consumer Debt Protection

- California: Robust homestead and wage exemptions, strong state debt collection laws (Rosenthal Act), and strict licensing for collectors.

- New York: It limits wage garnishment, protects more bank funds, and recently banned the reporting of medical debt on credit reports.

- Texas: Robust homestead exemption- your primary residence is always safe from creditors.

- Massachusetts, Arizona, New Mexico, and the District of Columbia offer broad protections for essential property, wages, and fair court procedures.

- Delaware, Alaska, and Pennsylvania also rank high for fairness in debt collection lawsuits and access to justice.

States with Weak Protections

- Georgia, Kentucky, Michigan, New Jersey, Utah, Wyoming: Minimal exemptions, meaning creditors can seize most assets and wages after a court judgment.

- Pennsylvania and Wyoming: Also rated low for consumer protection in debt matters.

Summary Table: State Consumer Protection Landscape

Protection Level | Example States | Key Features |

Strong (Grade B) | California, Arizona, Massachusetts, New Mexico, Texas | Broad exemptions for home, car, and wages; firm limits on collection actions; robust procedural protections |

Moderate (Grade C/D) | Nebraska, North Dakota, Washington, and others | Some protections for essential property and income, but significant gaps or outdated exemption limits remain |

Weak (Grade F) | Georgia, Kentucky, Michigan, New Jersey, Utah, Wyoming | Minimal exemptions; creditors can seize most assets and wages after judgment; limited procedural safeguards |

Why These Differences Matter

- Strong-protection states make it less likely that you will lose your home, car, or essential income due to a debt lawsuit.

- In weak-protection states, a court judgment can result in sweeping seizures of property and income, making it much harder to recover financially.

- Licensing rules: In many states, if a debt collector isn’t licensed, they can’t legally collect or sue you; it’s an essential shield against scams.

How to Check Your State’s Laws

- Visit your state Attorney General’s website for consumer debt resources.

- Look up debt collector licensing databases for your state.

- Consult guides from the National Consumer Law Center or local legal aid organizations.

- Seek advice from a consumer law attorney if you’re facing collection or a lawsuit.

Conculsion

Your rights and protections as a debtor in the U.S. depend heavily on your state of residence. States like California, New York, Texas, Massachusetts, and the District of Columbia shield consumers from the harshest consequences of debt collection, while others offer far less security. Understanding your state’s laws is the first step toward protecting your assets and planning a path out of debt.

Need help evaluating your options based on your state laws? Consult a local consumer law expert or reach out to reputable nonprofit credit counseling services for guidance.

Sources:

https://www.nclc.org/weak-state-exemption-laws-allow-debt-collectors-to-push-families-into-poverty/

https://www.nolo.com/legal-encyclopedia/california-fair-debt-collection-laws.html

https://www.nclc.org/topic/debt-collection/

https://ncaj.org/news/new-consumer-debt-litigation-index-ranks-states-best-policies-access-justice

https://www.ftc.gov/legal-library/browse/rules/fair-debt-collection-practices-act-text