Understanding Your Credit Score

Good Credit Score: How to Achieve It?

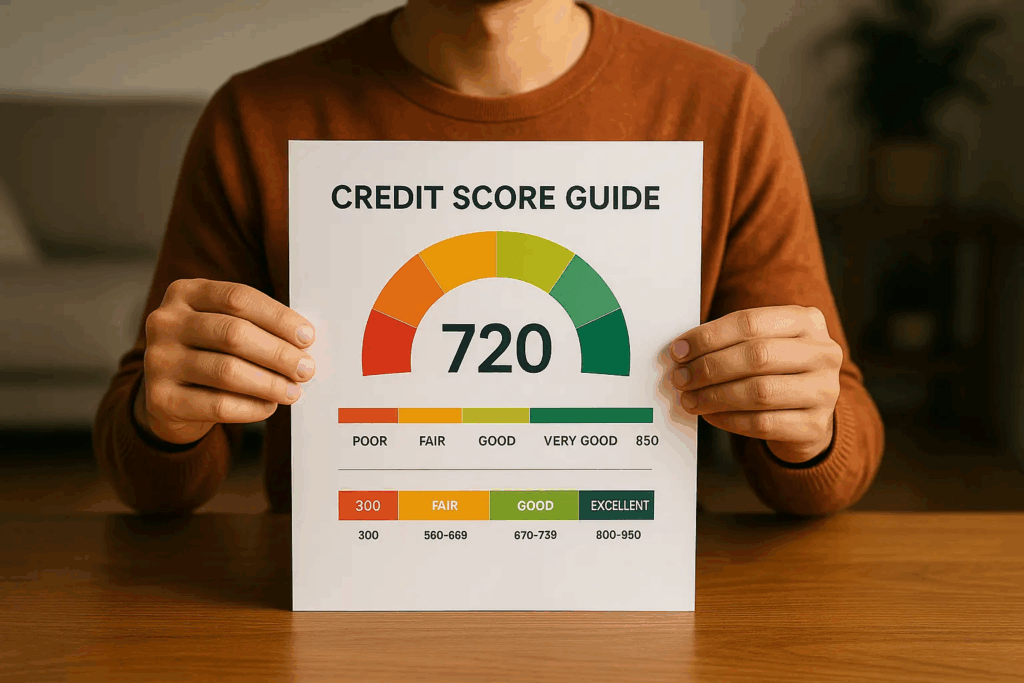

A credit score (300–850) reflects your current financial management—not your personal worth. In 2023, the average American score was 715. A score above 670 (FICO®) or above 661 (VantageScore®) generally unlocks competitive rates for loans, housing, or even insurance. The biggest influences on your score are on-time payments (35%), your credit utilization ratio (30%), and length of account history (15%). Fixing errors can save you up to $50,000 on a home loan, based on average rates. Improve your score for free via AnnualCreditReport.com, avoid closing old accounts, and lower your credit utilization. Understanding how these factors work helps you take control—without falling for false promises.

If you feel overwhelmed by late bills and a credit score that seems to control your life, this practical guide breaks down the mysteries of how scores work. You’ll see the score ranges—FICO (670–739 = Good) and VantageScore (661–780 = Good)—so you finally understand the numbers determining your access to housing and loans. Discover how a better score can save you thousands in interest and bust myths—like scams that claim to “repair” your credit for free.

- What Is a “Good” Credit Score, and Where Do You Stand?

- Why Your Credit Score Is the Key to Your Financial Stability

- The 5 Key Factors That Make Up Your Credit Score (and What You Can Control)

- Your Action Plan: 5 Concrete Steps to Improve Your Credit Score

- Credit Myths vs. Realities: What You’re Not Being Told

What Is a “Good” Credit Score and Where Do You Stand?

Credit Score Scales: FICO vs. VantageScore

Two scoring systems dominate the U.S. market: FICO® and VantageScore®.

- FICO® Score 8 is used by about 90% of U.S. lenders (Experian).

- Each uses a slightly different formula, so scores may differ.

Example: you might have a FICO® score of 680 (“Good”) and a VantageScore® of 650 (“Fair”). Both show similar trends, but lenders may use one or the other.

Credit Score Ranges — Corrected Table

Level | FICO® Score 8 | VantageScore® 3.0 & 4.0 | What It Means for You |

Excellent | 800–850 | 781–850 | Best interest rates and terms |

Very Good* | 740–799 | (No official “Very Good”; this range sits in the high end of “Good” 740–780) | Competitive rates and offers |

Good | 670–739 | 661–780 | Acceptable rates, easier approvals |

Fair | 580–669 | 601–660 | Higher rates, may need deposit |

Poor | 300–579 | 500–600 | Difficulty obtaining credit |

Very Poor | — | 300–499 | Most applications denied |

* VantageScore does not have a “Very Good” category; the equivalent range is part of its “Good” category.

Why Your Credit Score Is the Key to Financial Stability

Real Money in Your Pocket

Based on average 2025 market rates, a higher credit score generally means lower loan or insurance costs.

For example, with a $350,000 mortgage, the difference between a high- and low-tier rate can total tens of thousands of dollars over the loan term. For auto loans, a better score may mean interest at ~5% instead of ~10%, saving thousands over 5 years.

Note: These amounts are estimates based on typical national averages and will vary depending on rates, lender policies, and your personal profile.

Insurance premiums are also often affected—though most insurers use a credit-based insurance score, not your raw FICO®. These are calculated from similar credit data but weighted differently. In general, a good credit history is correlated with better premiums, but no exact discount is guaranteed since each insurer has its own criteria.

Opening Doors for Your Life Goals

A higher score can help you rent without steep deposits or qualify for better lease terms. Some landlords may accept lower scores with extra deposits, but policies vary greatly by market.

Even utility and phone service providers may require deposits of $200–$500 with lower credit, versus $50–$100 with good credit. Tools like Experian Boost or UltraFICO can add rent or utility payments to your report—helping build credit without taking on extra debt.

Regaining Peace of Mind

Consistently paying bills on time helps improve your score, but the point gain is not fixed—it varies by your credit history and profile. A late payment of 30 days or more can cause a significant score drop, but the exact impact depends on your situation.

You have the legal right to one free credit report each year (AnnualCreditReport.com), and the FTC reports that 1 in 5 people find an error that, once corrected, can improve their score.

As of 2023, medical collections under $500 no longer appear on credit reports from the major bureaus.

The 5 Ingredients of Your Credit Score (FICO® model)

- Payment History (35%) – Most important. Pay at least the minimum on time.

- Amounts Owed (30%) – Keep your utilization ideally below 30%, best under 10%.

- Length of Credit History (15%) – Older accounts help; closing old cards can hurt.

- Credit Mix (10%) – A variety of account types is positive.

- New Credit Inquiries (10%) – Hard inquiries may lower scores slightly; avoid many in a short span.

What’s NOT Included: Age, income, race, gender, and marital status are excluded from both FICO® and VantageScore.

5 Steps to Improve Your Score

- Pay on time—even the minimum.

- Lower your credit utilization.

- Keep old accounts open.

- Apply for new credit strategically.

- Check your reports regularly and dispute errors for free.

Credit Myths vs. Realities

- Myth: Checking your score lowers it.

Reality: Soft inquiries (like Credit Karma or bank apps) have no effect. - Myth: You must pay a company to “fix” your credit.

Reality: You can dispute errors for free with the credit bureaus. - Myth: Paying off collections removes them from your report.

Reality: They can remain up to 7 years, though their impact may lessen over time. Medical debts under $500 are excluded.

Conclusion

Improving your credit score is about consistent on‑time payments, smart debt management, and regularly checking your reports.

A good score lowers costs, opens doors, and brings financial peace of mind. Even starting from a challenging place, small, steady actions can make a real difference.

Tools That Help You Take Action

- Budget Planner Templates

- Financial Stress Self-Assessment

- Debt Type Awareness videos

- Income Irregularity Planning Tools

- Financial Glossary for Beginners

Respect, Privacy, and Clarity

We never ask for payment or sell your data.

Our mission is simple: to empower Americans with the financial knowledge they deserve.

If you want legal help, we’ll show you where to learn more—but the choice is always yours.