How to Check If a Debt Collector Is Legit: Spotting Scams & Protecting Your Rights

Worried about fake debt collectors? Discover how to verify the legitimacy of a debt collector, identify common scam red flags, and safeguard your rights under U.S. law. Get practical steps and trusted resources for U.S. consumers.

How to Check If a Debt Collector Is Legit

Being contacted by a debt collector can be stressful, especially if you’re unsure whether the call, letter, or email is real. With scams on the rise, U.S. consumers must know how to distinguish between legitimate and fraudulent debt collection attempts.

According to a Consumer Financial Protection Bureau (CFPB) national survey, about one-third of Americans —more than 70 million people—were contacted by a creditor or debt collector about a debt in the previous 12 months. Additionally, over one-in-four consumers contacted by debt collectors reported feeling threatened by the interaction. These statistics are directly from the CFPB and are widely referenced in industry reports.

This guide will help you identify red flags, verify a collector’s legitimacy, and protect your rights and finances.

Understanding the Uncertainty: Why Verification Matters

Millions of Americans receive debt collection communications each year, but many are left wondering if these contacts are genuine. Scammers are becoming increasingly sophisticated, often exploiting people’s anxieties to steal money or sensitive information. Knowing your rights and how to verify a debt collector is essential to avoid falling victim to fraud and to handle any legitimate debts confidently.

Know Your Rights Under the FDCPA

The Fair Debt Collection Practices Act (FDCPA) is a federal law that protects consumers from abusive, unfair, or deceptive debt collection practices. Here’s what you should know:

- No Harassment or Abuse: Collectors cannot threaten violence, use obscene language, or repeatedly call to harass you.

- Right to Request Debt Validation: You have the right to request written verification of the debt within 30 days of first contact. The collector must provide information about the debt, including the amount, the name of the creditor, and your rights to dispute it.

- No False Threats or Misrepresentation: Collectors cannot pretend to be attorneys or government officials, misrepresent the amount owed, or make false threats of arrest or legal action.

- Contact Restrictions: Collectors cannot contact you at inconvenient times (typically before 8 a.m. or after 9 p.m.) or at work if your employer prohibits such calls.

For more details, visit the Consumer Financial Protection Bureau (CFPB) or Federal Trade Commission (FTC).

Signs a Debt Collector May Be Fake

Watch for these red flags that often signal a scam:

- Urgency or Threats of Jail: Real collectors cannot threaten arrest or jail time. Hang up if you hear these threats.

- Refusal to Provide Written Verification: Legitimate collectors must provide a validation notice. If they refuse, be suspicious.

- Requests for Gift Cards or Wire Transfers: No real collector will ask for payment via gift cards, wire transfers, or cryptocurrency.

- No Company Name or Unclear Contact Info: Scammers often use generic names or avoid giving a physical address or company details.

- Refusal to Give a Mailing Address: A legitimate agency will always provide a mailing address for correspondence.

- Spoofed Local Numbers or Vague Voicemails: Be wary of calls from local numbers that don’t match the agency’s official contact info, or voicemails that are threatening but lack details.

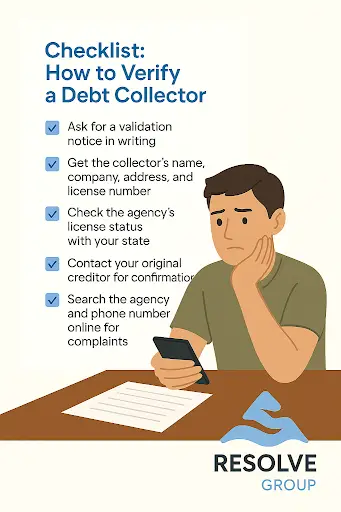

How to Verify a Debt Collector

Use this checklist to confirm if a debt collector is legitimate:

- Ask for a Validation Notice: By law, collectors must send you written notice about the debt within five days of first contact, detailing the amount owed and the creditor’s name.

- Request the Collector’s Name, Company, Address, and License Number: Write down these details and cross-check them online or with your state’s licensing database.

- Check Licensing Status: Many states require debt collectors to be licensed. Search for the agency in your state’s official database or through the NMLS Consumer Access portal.

- Contact Your Original Creditor: Call the company you originally owed money to and ask if they have sent your account to collections and to which agency.

- Search for Online Reviews or Complaints: Look up the agency’s name and phone number on sites like 800notes.com or WhoCallsMe to see if others have reported scams.

- Ask for a Call-Back Number: Compare it with the official contact numbers listed on the agency’s website.

- Red Flags: Be cautious if the caller pressures you to pay immediately, refuses to answer questions, or avoids providing documentation.

Downloadable Debt Validation Letter Template

If a debt collector contacts you, it’s your right to request written proof of the debt. Use our free template to request validation formally:

Download the Debt Validation Letter Template (PDF/Google Doc)

Why Licensing Matters (State-Level Requirements)

Debt collection licensing laws vary by state. Here’s why this matters:

- Many States Require Licenses: If a collector is not licensed in your state, they may be operating illegally and cannot sue you.

- Strong Red Flag: Lack of a license is a significant warning sign of a scam.

- You Can Refuse Communication: If a collector isn’t licensed, you can refuse to speak with them and demand written validation.

How to Check Licensing Status

- Your State Attorney General’s Office: Search for “debt collection license + [your state]” on your state’s official website.

- State Department of Financial Regulation or Consumer Affairs: Many states offer searchable online databases.

- City Regulations: Some cities have their own licensing requirements for debt collectors.

State Differences: For example, Georgia and North Carolina require that only attorneys handle debt settlement, and licensing rules can differ significantly across the U.S.

What to Do If You Suspect a Scam

If you think you’re dealing with a fake collector:

- Don’t Pay or Share Personal Information: Never provide payment or sensitive details until you verify the collector’s legitimacy.

- Report the Incident: File a complaint with the CFPB, FTC, and your state’s attorney general.

- Keep Written Records: Save all communications, letters, and voicemails for your records.

- Consult a Professional: If unsure, seek advice from a consumer attorney or a reputable debt relief organization.

When the Debt Is Real but You Disagree With It

If you recognize the debt but believe the amount is wrong or the debt isn’t yours:

- Request Debt Validation: Send a written dispute within 30 days of receiving the validation notice. The collector must stop collection efforts until they provide written verification.

- Dispute Incorrect Amounts or Mistaken Identity: Provide any supporting documentation (such as police reports for identity theft) when disputing the debt.

- Know Your Rights: The collector cannot continue to pursue payment until they resolve your dispute.

For more on the debt validation process, see the CFPB’s guidance.

Conclusion

Knowing how to tell a real debt collector from a scammer is vital for protecting your finances and credit. By understanding your rights, recognizing red flags, and verifying licensing, you can confidently handle debt collection contacts and avoid fraud.

Are you unsure if the debt is real or what to do next? We can help you connect with a professional who understands the law and your rights.

External Resources for Further Reading:

- Consumer Financial Protection Bureau: How do I tell if a debt collector is legitimate or a scam?

- Federal Trade Commission: Fake and Abusive Debt Collectors

- Your State Attorney General’s Office

- National Multistate Licensing System (NMLS) Consumer Access

Checklist: How to Verify a Debt Collector

- Ask for a validation notice in writing

- Get the collector’s name, company, address, and license number

- Check the agency’s license status with your state

- Contact your original creditor for confirmation

- Search the agency and phone number online for complaints

- Never pay or provide information until you’re sure

If you have doubts about a debt collector or need help disputing a debt, consider contacting a consumer protection attorney or a certified debt relief professional. Your financial security is worth the extra step.

FAQ: Debt Collection – What U.S. Consumers Need to Know

What is a debt validation letter?

A debt validation letter is a document that a debt collector must send you, either before contacting you or within five days of their first communication. This letter provides crucial details about the debt, including the amount owed, the name of the original creditor, and your rights to dispute the debt. Under the Fair Debt Collection Practices Act (FDCPA), you have the right to request this letter to ensure the debt is legitimate and actually yours. If you don’t receive a validation letter, or the collector refuses to provide one, this is a major red flag and you should not make any payments until you receive proper documentation.

Can debt collectors call my employer?

Generally, debt collectors are NOT allowed to call you at work if they know your employer prohibits such calls. If a debt collector contacts you at your workplace, you can tell them your employer does not allow personal calls, and they must stop. The FDCPA requires collectors to respect such requests. There are exceptions: if you have given the debt collector written permission, or if a court judgment has been entered against you, they may be allowed to call. However, even then, they cannot discuss your debt with anyone except you, your spouse, or your attorney. If a collector continues to call after being told to stop, you can report them to the Consumer Financial Protection Bureau (CFPB) or your state attorney general.

What happens if a debt collector can’t prove the debt?

If a debt collector cannot provide documentation to validate the debt after you request it, they are not legally allowed to continue collection efforts. If they persist, you have the right to sue them in federal or state court, and you may be entitled to statutory damages (up to $1,000 per lawsuit under the FDCPA), plus actual damages and attorneys’ fees. In some states, you may be able to recover even more. If a collector sues you without proof, you can ask the court to dismiss the case or require the collector to provide the missing documentation. Always keep written records of your requests and any collector responses.

What’s the difference between a debt validation letter and a debt verification letter?

A debt validation letter is what the collector must send you, outlining details of the debt. A debt verification letter is a letter you send to the collector, requesting more information or formally disputing the debt. If you send a verification letter within 30 days of receiving the validation notice, the collector must stop collection efforts until they respond with the required information.

Can I refuse to pay a debt if the collector isn’t licensed in my state?

Yes. Many states require debt collectors to be licensed. If a collector is not licensed in your state, they may be breaking the law and typically cannot sue you there. You have the right to refuse communication and demand written validation before further action.

What should I do if I suspect a debt collection scam?

- Do not pay or share personal information until you verify the collector’s legitimacy.

- Request a debt validation letter.

- Report suspicious activity to the CFPB, FTC, or your state attorney general.

- Keep all written records of communications.