Guide to Medical Debt in the United States

What Is Medical Debt?

Medical debt is unsecured debt that results from unpaid healthcare expenses. It can come from hospital bills, emergency care, outpatient services, or prescription medications. Because it is not backed by collateral, it relies solely on your promise to pay.

Unlike credit card debt, medical debt often arises unexpectedly and may occur even if you have insurance, due to high deductibles, out-of-network charges, or denied claims.

Why Does Medical Debt Often Go to Collections?

- High Costs of Care: The average cost of an emergency room (ER) visit without insurance ranges from $1,500 to $3,000, with most individuals paying around $2,100 for non-life-threatening issues (BetterCare). Major surgeries can cost tens or even hundreds of thousands of dollars.

- Insurance Gaps: Even with coverage, many patients face large out-of-pocket bills.

- Billing Complexity: Confusing or delayed medical billing makes it hard to verify and pay on time.

- Lack of Immediate Payment Expectation: Providers often bill after treatment, and unpaid balances may go unnoticed until they are sent to collections.

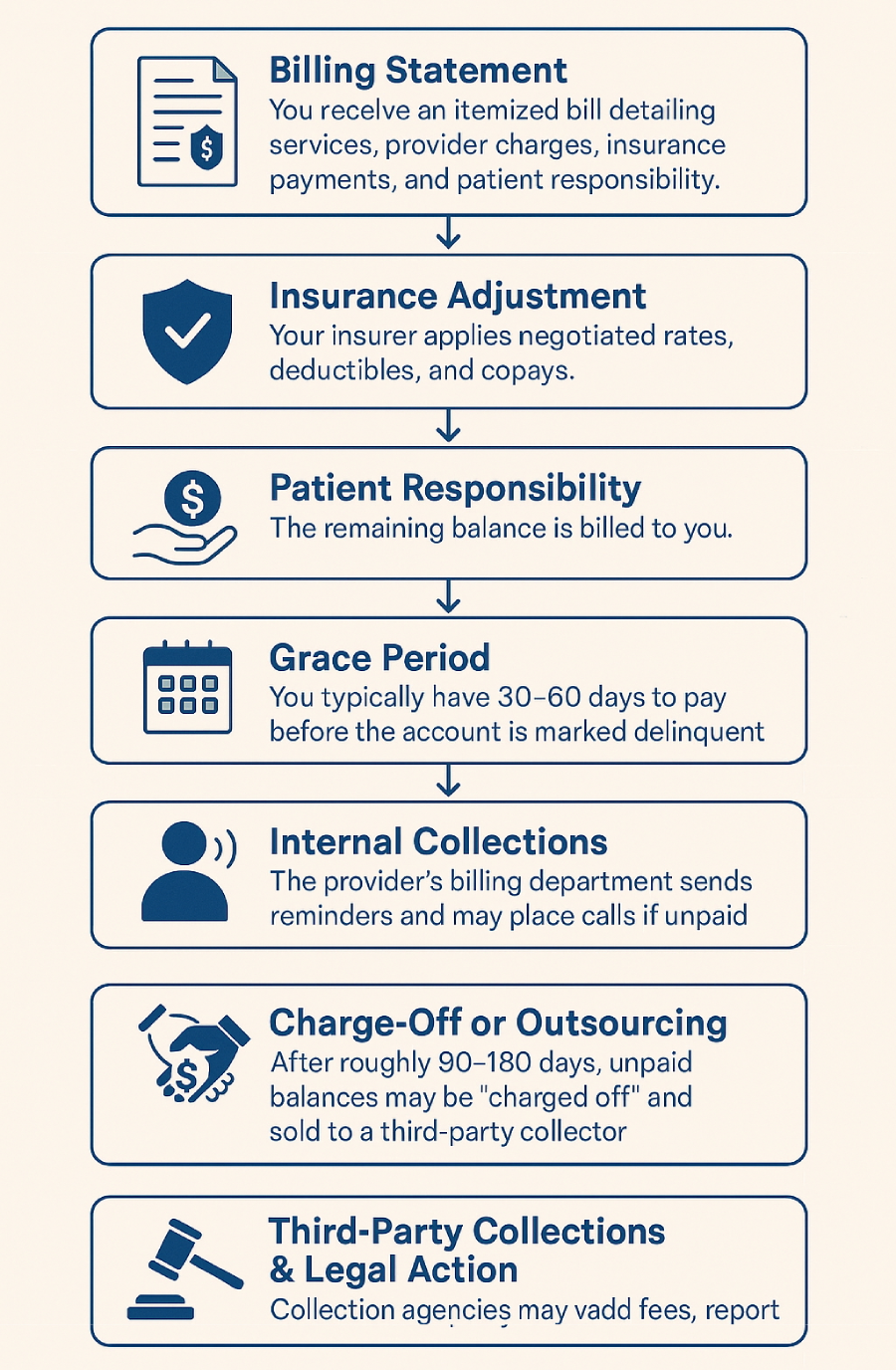

The Medical Debt Collection Process

- Initial Billing: After treatment, a provider bills you directly or through your insurance.

- Late Payments: If unpaid after 60–120 days, the provider may report it as delinquent.

- Collections: The debt may be turned over to a collection agency.

- Credit Reporting: As of 2025, medical debts are no longer included on credit reports provided to lenders, regardless of the amount or age of the debt. Lenders are also prohibited from considering medical debt information in credit decisions. This new rule replaces earlier policies that only excluded debts under $500 or those less than a year old.

- Legal Action: In some cases, collectors may sue for payment. This can lead to wage garnishment or bank levies depending on your state.

Debt Settlement for Medical Bills

- What It Is: Negotiating to pay less than the full amount owed—typically in a lump sum.

- Who Can Help:

- You can negotiate directly with the provider or collector.

- Attorneys or debt settlement companies may assist, though some states regulate who can perform this service.

- When It’s Effective: After the debt has aged (typically over 180 days) or been charged off.

Credit Impact: As of 2025, settled or unpaid medical debt no longer appears on credit reports used by lenders, so it does not impact your credit score.

Consumer Rights and Protections (Medical Debt)

Federal Law: FDCPA and Medical Debt

The Fair Debt Collection Practices Act (FDCPA) protects you from harassment and unfair collection tactics, including for medical debt. Collectors must be able to prove you owe the debt and cannot pursue collection for debts that are not owed. Collectors cannot:

- Call you at unreasonable hours

- Lie about the amount you owe

- Threaten actions they can’t legally take (like jail)

Right to Validation of Medical Debt

You have the right to request a written verification of the medical debt. The collector must provide:

- The name of the healthcare provider

- The exact amount owed

- A statement of your right to dispute the debt within 30 days

Tip: Always ask for an itemized bill to compare with your Explanation of Benefits (EOB). Medical billing errors are common.

State Law Protections (Medical Context)

- example, Colorado exempts wages from garnishment for medical debt if family income is below 400% of the federal poverty level. Florida requires hospitals to give a 30-day written notice before extraordinary collection actions, such as selling the debt or initiating a lawsuit.

- Some states also regulate how hospitals and collectors must notify you of financial assistance options before pursuing collection.

State Licensing Requirements for Collectors

As with other types of debt, whether a medical debt collector needs to be licensed depends on your state:

States That Do NOT Require Licensing (as of 2024): Georgia, Kansas, Kentucky, Michigan, Missouri, Montana, New Hampshire, Oklahoma, Pennsylvania, South Carolina, South Dakota, Tennessee, Wyoming

Even in those states, some cities or counties may have local requirements.

If a collector is not licensed where required, they usually cannot sue you, and it may signal a scam.

Why Licensing Matters

Licensing ensures that:

- The collector follows state rules for consumer protection

- You can file a complaint if the agency acts abusively

- You’re less likely to fall victim to fraudulent medical debt collection

How to Verify a Medical Debt Collector

- Request written validation of the debt (name of hospital/clinic, service date, itemized total).

- Check licensing via your state Attorney General or Department of Health or Consumer Affairs.

- Call the original healthcare provider to verify the agency is authorized to collect on their behalf.

- Watch for red flags:

- Requests for payment via gift cards or Venmo

- Refusal to provide written documentation

- Threats of jail (which are illegal)

Options for Managing Medical Debt

- Check for Billing Errors: Request an itemized bill. Many contain duplicate or incorrect charges.

- Request Financial Assistance: Nonprofit hospitals are required by federal law to inform patients about charity care and income-based discounts before pursuing collection actions.

- Negotiate a Settlement: Especially after the debt is sent to collections. This can be done by yourself or with a lawyer.

- Dispute the Debt: If you believe it’s invalid or inflated, request validation. Unverifiable debt must be removed from your credit report.

- Debt Resolution Programs: Some attorneys or consumer advocacy groups offer bundled services (dispute + negotiation + credit repair).

- Bankruptcy: In extreme cases, Chapter 7 or 13 can discharge medical bills. Rules vary by state.

Key Takeaways

- Medical debt is one of the most common and unpredictable forms of debt in the U.S.

- Consumers are protected by federal and state laws, including FDCPA and state charity care rules.

- Always verify bill accuracy and collector legitimacy before paying.

- Don’t ignore medical debt—it can still lead to collections, lawsuits, or credit damage, especially for large balances.

- Financial assistance is often available but must be requested proactively.

Sources

- https://www.consumerfinance.gov/about-us/newsroom/changes-medical-debt-reporting/

- https://www.kff.org/health-costs/issue-brief/medical-debt-in-the-us/

- https://www.consumerreports.org/medical-debt/guide-to-handling-medical-debt-a3001928784/

- https://www.hhs.gov/about/news/2023/09/21/fact-sheet-hhs-announces-steps-crack-down-on-unfair-medical-debt.html

- https://bettercare.com/costs/er-visit-cost

- https://www.marktyoung.com/blog/2024/01/how-much-does-surgery-cost-in-the-united-states/