Take Control of Your Debt — Start With a Free Debt Check

Get a confidential overview of your situation and see what options may be available — in under 2 minutes.

- Check your debt profile quickly and securely

- See a clear summary of your options

- If you prefer, request a call using the form below

Or request a confidential call

No obligation. Private & confidential.

What happens after you complete the debt check?

- 1. Quick summary

You get a quick summary of your situation.

- 2. Options overview

If you qualify, you’ll see recommended next steps based on your inputs.

- 3. Choose your path

You can continue online or request a confidential call.

Trust & Privacy

- Secure & Confidential

- No Credit Score Impact

- No Obligation

- Results Vary by Individual Circumstances

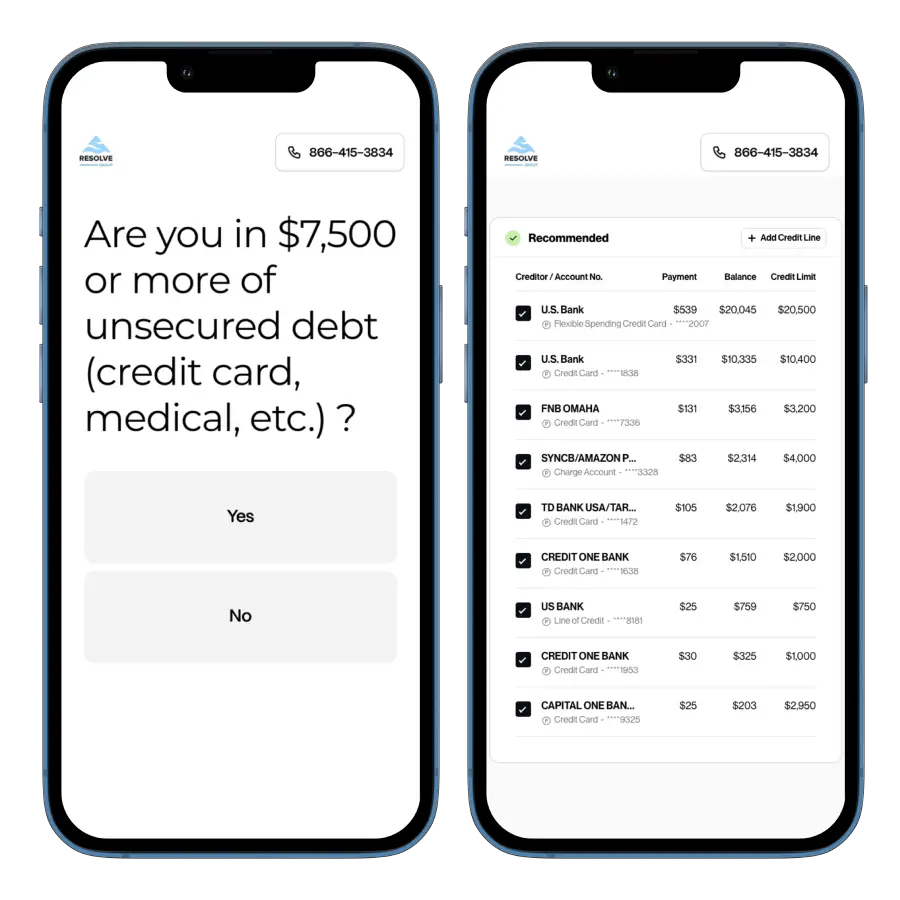

EXAMPLE (Illustrative only)

A debt check can help you understand possible paths such as monthly payment planning, creditor hardship options, or other strategies depending on eligibility.

Examples are illustrative only. Results vary based on individual circumstances and creditor participation.

Illustrative scenarios only. Outcomes vary by individual circumstances, creditor participation, and eligibility.

Path A: Stable 36-Month Resolution Plan

Illustrative scenario: The customer chose a 36-month repayment path with predictable monthly payments. After renegotiation, enrolled balances were reduced by 30%+, creating a clearer and more sustainable plan.

- 30%+ negotiated reduction on enrolled balances

- Clear monthly payment structure over 36 months

- Less pressure from a simpler repayment roadmap

- Regular progress tracking and specialist support

Katerine T.

Teacher

Path B: 24-Month Accelerated Recovery Plan

Illustrative scenario: The customer selected a 24-month path, with a manageable phase in months 1-12 and an accelerated repayment phase in months 13-24. They felt well accompanied throughout the process, with clear guidance at each step.

- Structured 24-month timeline

- Acceleration of repayments after month 12

- Faster debt exit versus longer plans

- Strong specialist follow-up and support

Vince C.

Assistant manager

Frequently Asked Questions

Yes. The debt check is free and confidential.

Most users complete it in under 2 minutes.

No. The debt check does not impact your credit score.

Basic contact and debt-related details are usually enough to begin.

Yes. You can opt out according to communication preferences and applicable policies.

Prefer to speak with someone?

If you’d rather talk to a specialist first, use the form below and we’ll follow up confidentially.

Disclaimer:

This tool is for educational purposes only. Results are estimates and do not guarantee specific outcomes. Resolve Group is not a lender. Debt-settlement services are provided by licensed attorneys where available.